The truth about Hunter Biden’s tax evasion scheme and the preferential treatment he enjoyed during his father’s presidency is revealed by his sudden decision to drop his case against IRS whistleblowers. In addition to validating the whistleblowers who revealed preferential treatment in Hunter’s tax investigation, the dismissal, which was filed “with prejudice,” meaning it can never be refiled, reveals Hunter’s fear of being scrutinized in court.

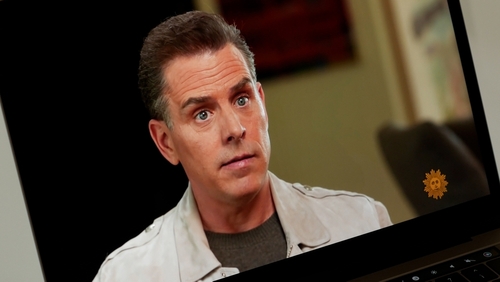

Hunter Biden Drops Lawsuit Against IRS Whistleblowers

Hunter Biden has abandoned his lawsuit against IRS agents Gary Shapley and Joseph Ziegler, who previously testified about interference in the investigation of his tax crimes. The lawsuit, dismissed with prejudice in September 2023, accused the whistleblowers of improperly disclosing his tax information during their testimony before Congress.

— Empower Oversight (@EMPOWR_us) May 1, 2025

The abrupt dismissal came shortly after Hunter’s attorneys withdrew from representing him, signaling potential concerns about the case’s merit. This development follows a pattern of legal retreats for the president’s son, who faced nine federal tax charges for failing to pay $1.4 million in taxes between 2016 and 2019.

Whistleblowers Call It Vindication

IRS agents Shapley and Ziegler viewed the lawsuit as an intimidation tactic and celebrated its dismissal as confirmation of their truthfulness. The whistleblowers had reported being blocked from pursuing standard investigative steps in the Hunter Biden case, including searching properties and interviewing key witnesses.

Hunter Biden abruptly drops lawsuit against IRS — a move the whistleblowers say shows ‘everything you need to know’ https://t.co/4H0YlrfPtB pic.twitter.com/NMyLZdpzCH

— New York Post (@nypost) May 1, 2025

Their attorneys released a statement saying: “Hunter Biden brought this lawsuit against two honorable federal agents in retaliation for blowing the whistle on the preferential treatment he was given.” Shapley had publicly exposed these concerns in a CBS interview, highlighting the Justice Department’s delays and interference in pursuing the full scope of Hunter Biden’s tax violations.

Presidential Pardon Ends Legal Accountability

Hunter Biden’s legal troubles temporarily concluded when he eventually pleaded guilty and repaid the $1.4 million in taxes he owed. However, any remaining accountability vanished when President Biden granted his son a sweeping pardon in December, covering all potential federal crimes committed over the previous decade.

“His voluntary dismissal of the case tells you everything you need to know about who was right and who was wrong,” said Shapley and Ziegler following Hunter’s withdrawal of the lawsuit. The whistleblowers had faced significant professional risk by exposing how Hunter Biden received special treatment during the tax investigation, including warnings about planned searches and limitations on investigative scope.

This case highlights ongoing concerns about politically connected individuals receiving preferential treatment from federal agencies. President Trump briefly appointed Shapley as acting IRS commissioner following the revelations, recognizing the importance of accountability and transparency in federal investigations regardless of political connections.

Sources:

https://www.washingtontimes.com/news/2025/apr/30/hunter-biden-drops-lawsuit-irs/